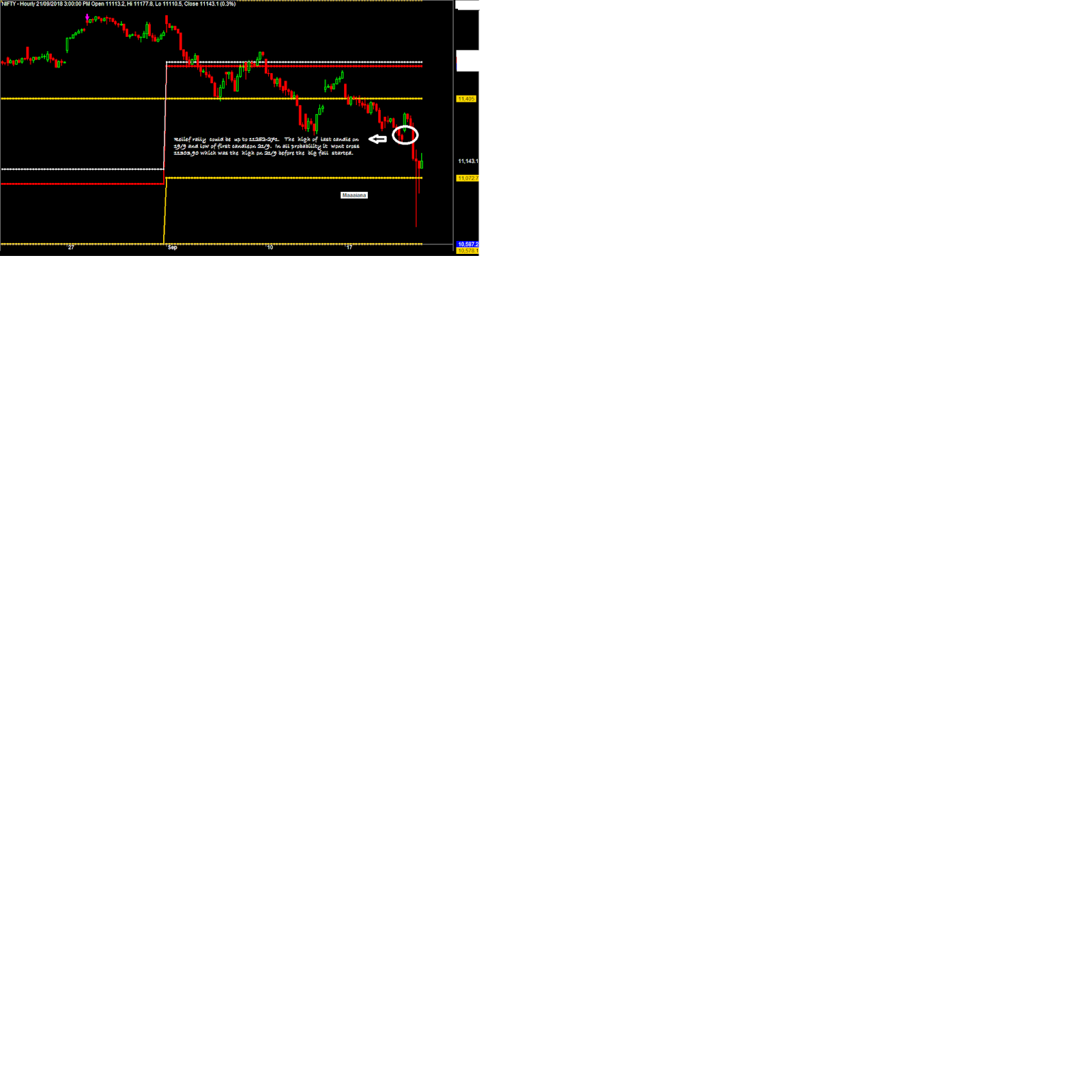

Nifty Future has strong support at 11005 and BNF at 25228. Initiate PE only if these levels are broken for intra day trade tomorrow.

For positional trade one should wait for nifty to break 10912/866 and BN 24678.

Do wait for trade. Any gap up opening also is getting sold and index is pulled down.

Allow the expiry to complete. Wait for direction.

No trade till then!

For positional trade one should wait for nifty to break 10912/866 and BN 24678.

Do wait for trade. Any gap up opening also is getting sold and index is pulled down.

Allow the expiry to complete. Wait for direction.

No trade till then!