Watch Bajaj FInance - 7600 CE and Bajaj Finserv - 1960 CE

Wednesday, 25 September 2024

Monday, 23 September 2024

Alert to Option Traders

Never hold any position and wait during the day. The volatility (VIX) is surging. The violent moves in nifty and other major indices will erode your capital.

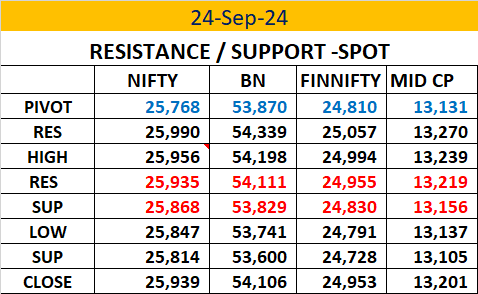

Unless you know the support and resistance levels before starting the day, your wild guess will hurt you.

Use the intraday levels posted in my blog everyday.

Be a smart trader! Good Luck!

Sunday, 22 September 2024

REPORT FOR THE WEEK 23/9/24 TO 27/9/24

Near Term and Medium Term view on Nifty and Bank Nifty

GLOBAL

CUES

The rate cut of 50 BPS rolled out FED and further projection of

another 50 BPS in this year has improved the investor sentiment. This should

give support to global market for some time.

Nifty (25790.95):

Nifty crossed 25450,85. Being previous week high making a new

high of 25849, and closed at 25790.95 up by 1.71%.

Next week View : Nifty likely to test the next resistance

level of 25950-975 level and a daily close above 25950 will lead to 26115 while

it enjoys a strong support near 25500-550 level.

Medium Term View – Nifty’s support moves up to 25000-25200. This level offers a very strong

support to nifty and if it sustains then nifty is likely to touch 26900-27100.

Long term View: As the

ongoing bullish trend is intact, nifty is expected to move towards 26900/27200

in the coming months and any reversal from there could drag nifty till 24750. If due to any reason nifty breaks 24750, it

could lead to a further fall up to 24000.

Bank Nifty ( 53793.20)

Next week view: BN has closed above previous high of 53350

and it is all set to move towards 54600-750.

Trading range for the coming week is 53400-54600/750.

Medium Term view :

Nifty Bank’s strong support is at 52600. Fall below 52600 is less likely. Bank

Nifty should clinch 55500-55750 in the course of next 2 months.

DOW Jones Industrial Averages (42063)

The index has closed with a strong note. The bullish view is

intact. It can move towards 42800 next week. From a medium term point of view Dow has the

potential to move up to 44000-44500. A sharper correction is expected once it

touches 44.5k.

**********

Thursday, 19 September 2024

Monday, 16 September 2024

Thursday, 12 September 2024

Yesterday Nifty Move

The move of yesterday was not a surprise to us. I have already alerted comparing with Dow move.

See my chart below"

NIFTY - WHAT NEXT?

Nifty crossed the last week high and the last hour of trade witnessed huge short covering which led to 25433. - 254527 was my target ( Chart as below).

Today also we can expect a tepid start and a weekly close above 25500 is expected.

Wednesday, 11 September 2024

DOW - WOW. !!!!! WHAT A SWING!

Dow yesterday made a fantastic recovery. From -700 it recovered fully and closed on a positive note.

I would rather say it is a killer move whereby all Shorts have been covered.

Our market may witness such wild move today, with a happy ending. Be prepared.

NEXT MULTIPLE RETURN ON STOCK OPTIONS???

We have again identified 3 solid picks - I can give a clue -

One scrip starting with A and other 2 scrips starting with S.

Do your research.... I will post scrip after the the trade. Wait till Monday.

SCRIPS - FUTURES - WHAT WE PREDICTED YESTERDAY

We predicted SIEMENS and ABB -

ABB 8000 CE 52 LOW 76 HIGH

AND SIEMENS 6900 CE - 87 HIGH 52 LOW

GAVE FANTASTIC RETURNS

WHAT ELSE YOU WANT?

The scrips are analyzed so that the levels are released before market hours.

Any one willing to see how it works can take only One day trial. please message me on whatsapp. 7010419004.

Tuesday, 10 September 2024

3 STOCK - FUTURES IN BUY .

Three scrips are in BUY as per our research team Nifty may go anywhere. But these scrips are going to make a good move. BUY level SL and Targets are already given to members

Wednesday, 4 September 2024

NEXT SCRIP EXCELLENT SET UP

We are ready with next scrip. to move up from bottom. Already recommended to Clients

GRASIM ROCKED.

Today Grasim 2700 CE rocked. recommended near 75 and it went up to 104. First target 81 second target 9 and third target with trailing SL order.

Cheers!

Monday, 2 September 2024

Sunday, 1 September 2024

REPORT

FOR THE WEEK 2/9/24 TO 6/9/24

Near Term and Medium Term view on Nifty and Bank Nifty

GLOBAL

CUES

The rate cuts expected to be rolled out from September by

FED, has limited impact on Indian market. The interest cost as a percentage to

PAT has declined from FY 2020 levels, limiting the impact of rate cycle.

Steel and power generation could witness 4-6% improvement in

PAT in case of 100 BPS decline.

Nifty (25235.90):

As mentioned earlier, nifty crossed 24855 which was the

triple top made earlier and came down by 1000 points near 23893. Again filling

the gap of 24687 gave fuel to nifty to cross previous high of 25078. The nifty

closed at 25236, which is above the resistance level, keeping the bullish view

intact.

Next week View : Nifty has a strong support at 25125 and a

stiff resistance near 25460. This could be the trading range of Nifty during

the coming week.

Medium Term View – Nifty has a strong support at 24850. This

level offers a very strong support to nifty and if it breaks, then next support

is at 24450.

Long term View : As

the ongoing bullish trend is intact, nifty is expected to move towards

26500/27200 in the coming months and any reversal from there could drag nifty till 24000. If due to any reason nifty breaks 23893 (low

of this month), it could lead to a further fall up to 22250.

Bank Nifty ( 51351)

Next week view: BN has not crossed the psychological comfort

level as we see in case of Nifty.

Trading range for the coming week is 50800-51800.

Medium Term view :

Nifty Bank is is likely to move towards 52500 if it closes above 51500

on a weekly closes basis. On the contrary, if it closes below 50900, then 50500/300

act as a strong support.

Long term view : Nifty bank range for the next 3 weeks is

52100-53200. On the down side it could be 50500/49975, if 49975 gets broken

then next support is at 46077, if any dramatic change happens in US before

elections.

DOW Jones Industrial Averages (41563)

The index has closed with a strong note. The bullish view is

intact. It can move towards 42000 next week. From a medium term point of view Dow has the

potential to move up to 44000. A sharper correction is expected once it touches

44k.