If Nifty spot close above 10871,do exit from PEs. Just a word of caution to all.. Take care

Monday, 31 December 2018

NIFTY TREND

The trend is up. A daily close above 10939 shall lead to 11050. Any dip is buy. Do not short the index.

We have planned and executed our trade.. What about you??

We have planned and executed our trade.. What about you??

Sunday, 30 December 2018

NIFTY TREND

Nifty closed at 10860 signalling more up move in the offing. A daily close above 10939 indicates tight grip of market by bulls. Bank Nifty has already confirmed up move. Be on the long side to enjoy rain of gains.

Nifty spot buy at CMP, SL 10750, Tr 11045. Bank Nifty buy at 27100 SL 26965 Tr 27300.

Good Luck. Enjoy New Year's eve with a big bang!

Wednesday, 26 December 2018

NIFTY TREND

Nifty has entered in to buy mode and closed very near 10750 mark which is very crucial. The global cues are positive and we do expect a close above 10800. Since our market has not reacted too much when Dow was sliding down, one can expect a tepid start and a slow and steady up move today.

Do not short index or buy PE if Nifty hovers below 10800 in the morning session. It could be short covering of futures and CEs.

Nifty spot may close around 10912 and bank nifty spot 27197.

For expiry trade, be on the long side by taking OTM CE of 3rd January 2019 expiry.

Good Luck!

Friday, 21 December 2018

Nifty trend

Yesterday all my members could make entry at opening and made good gains. When all analysts said 11100-400, we took a decision as the charts confirmed sell.

Believe in yourself.

Now we wait for reversal.

yesterday's reversal was posted well in advance.

Good luck!!

Believe in yourself.

Now we wait for reversal.

yesterday's reversal was posted well in advance.

Good luck!!

Wednesday, 19 December 2018

NIFTY TREND

Nifty likely to be gap down as the correction is going to wipe out weak investors who were hanging on to OTM CEs.

See my post on Monday signalling the correction.

I have given a clear range in the beginning of the month 10699-11019. This has worked perfectly without any mistake.

With just 4 days remaining for December expiry, next week is truncated due to X-mas, one must exercise extreme caution while buying CEs. Because the sentiment in US market does not augur long position.

Be short till 10752/768 and you can go long from this level on a daily close above this number.

Good Luck!!

Tuesday, 18 December 2018

NIFTY TREND

Nifty did opened gap down, but the same story repeated. It was not breaking 10800 to initiate PE buying.

Today's close indicates further momentum in nifty which can take to 11020 as indicated in the beginning of the month.

Be long in this market till we reach 11020 if Nifty spot holds 10967 on daily/ hourly candle.

Happy Trading!

Monday, 17 December 2018

TREND REVERSAL

The trend reversal should begin from today. Yesterday the formation was visible. But it is not prudent to short Nifty when the closing was near day high and the low of 10844 was not breached yesterday.

If the Nifty opens with a slight gap up, one can short CEs of 11000, 10900 and initiate PE buy ranging from 10800-650. This PE buy should give a decent return of 40-70% return. This strategy should hold good for next 2 days.

Dont be panic. This is a regular course of small correction to wipe out weaker traders who have entered CEs during the last two days with greedy intention to multiply their investment.

GOOD LUCK!

Wednesday, 12 December 2018

NIFTY TREND

My previous posts have been very sharp on the December trend in Nifty. Had anyone followed my advise they would be sitting pretty on 10500 CE when the index roamed at low of 10400-440 on Tuesday.

The trend is bullish. Do not expect reversals in the next 2-3 sessions, ofcourse there could be a halt by way of consolidation.

Watch out for trend reversal in my blog when it happens...

Be long and be blessed with more gains!

Good Luck!

Tuesday, 11 December 2018

NIFTY TREND

The election mandate, resignation of RBI Governor, fresh trade war and all negative news passed. As indicated earlier that irrespective of mandate, market will move up, the index obeyed. Now any dip is buy and you should not miss the bus.

Of course, there is a hurdle at 10593. If nifty spot closes above 10699 on a daily or weekly basis, then you can see non-stop rally up to 11020.

We have picked PEs, when the market was falling. And yesterday we have already initiated buying CEs. When you go by trend, you won't miss trade.

I avoid frequent posts and give tips only when the nifty path is clear.

Happy Trading!

Friday, 30 November 2018

DECEMBER SERIES - HOW IT LOOKS LIKE?

December series should be bullish irrespective of the outcome of election mandate.

The trading range for nifty till 12th is broader, say from 10699 to 11019. For bank nifty it is 26700 to 27200.

At low grab CEs and at highs grab PEs till 11th. There after be cautious and be on the long side to make handsome gains.

You cannot get a better option strategy than the above.

Good Luck to everyone and be a winner.

NIFTY TREND

I gave a very clear message on the expiry move. Those went long after seeing nifty above 10775 must have doubled. Bank nifty levels were also perfect and it was a day of rain of profits to all the members.

December series have started with a positive note. But be cautious as the Volatility Index again has climbed up indicating high premiums on both CE and PE.

The trend could remain till the election results.

Recap of previous expiry option trade:

For my members I have worked out 10500-700 CEs with entry, SL and target on 15th of November and all the options more than doubled.

This month also already suggested entry level for CEs and PEs.

Remember for taking out profits from market, money is not important. Patience is the only key.

Happy Trading!!

Wednesday, 28 November 2018

Have you doubled?

I have given clear message to go long on CE above 26000 on bank nifty for doubling. If you have simply followed this message, you could have doubled your money by now.

Check my previous post. Be technical. Don't be emotional.

Good Luck!

NIFTY TREND AND EXPIRY MOVE

As per the earlier post, a close above 10627 has taken nifty beyond 10700. I have avoided frequent posts as the move was with in a specific range.

I have also given strike price of 10500-700 CE with entry price, SL and Target to all my members and they all are enjoying the move and doubled already.

Expiry Move:

If nifty spot is able to hold above 10775 for more than an hour today, then the target should be 10800 +. So be on the long side on expiry day.

Bank Nifty target 26676/925.

Wish you all good luck!

I have also given strike price of 10500-700 CE with entry price, SL and Target to all my members and they all are enjoying the move and doubled already.

Expiry Move:

If nifty spot is able to hold above 10775 for more than an hour today, then the target should be 10800 +. So be on the long side on expiry day.

Bank Nifty target 26676/925.

Wish you all good luck!

Wednesday, 14 November 2018

NIFTY TREND

The situation has not changed since my last post here. Nifty is struggling to cross 10600 and hovering in a broad range between 10440-10650. Only a decisive close above 10627( low made on 17/10) will take the market up.

Why 17/10 ?

That was the day BN made high during October month. So that number is critical. BN has closed above 25915 today but nifty has not closed above 10627 which was the low made on 17/10.

Unless both the index meet the technical requirements, you cannot expect BN to move up.

Calls above 26000 likely to go worthless while Puts below 25800 equally be worthless. A cautious approach is needed in Bank Nifty trade today. BN has taken support 25800 twice yesterday. It may not breach this number today.

Since you have another half month and the BN target is 26800, you cannot expect any big move.

Those who trade in index future can go long on any dip. Those in Option trade must wait till mid of next week and accumulate month end CEs above 26200 to 26500 and hold till expiry for big gains which should go more than double.

On any day Nifty close above 10627, go long in CE 300 points above 10600. You are destined to double your investment for sure.

Take CEs above 26000 for next week if you want to be a winner. Don't be on the Put side.

Happy Trading!

Thursday, 8 November 2018

NIFTY TREND

Nifty closed 68 points up on Muhurat trading day. It was an attempt to keep the mood positive on New year.

The VIX is still above 18% which is not a comfortable level to go long in this market. Wait for a dip to enter into market. 10375 should be the level where you can go long with strict SL @ 10275. Nifty monthly target 10800/11000.

Bank Nifty is not likely to give up 25219 till the end of this month expiry. BN Target 26740.

Option trade is advised for members on board.

Happy Trading!

Wednesday, 31 October 2018

NIFTY TREND

The index showed high volatility as expected. The VIX shoot up to 22.8% during the day and finally cooled off to 19.% at EOD. Good rally from 10105 to 10375 was anticipated. Members were given the level of 10160 for a gain of 25-30%.

Since the VIX was high, no carry over has been suggested and only intra day trade was suggested. Those picked 10500/600 CE have booked more than 30% profit as the entry was around 70 and exit above 100.

10400 -450 looks very crucial and index may find it difficult to sustain the level. Extreme caution is needed if any one goes long at this juncture.

Bank Nifty weekly expiry can see maximum 25375 and on the lower side 24906.

Happy Trading!

Monday, 29 October 2018

NIFTY TREND..

Both Nifty and bank nifty obeyed the levels and closed above 10250/24925 yesterday. Remember, if the first day of the week start with a bullish note, you may expect the trend to continue. Trend reversal is seen in Nifty and BN yesterday when the upward rally started by 2 PM. The bottom as of now is 10104.

Points to note :

1. Volatility index is high. It has to cool down.

2. The CE premium is high. For example 10500 CE premium is 111 when the index is at 10250. One must wait for premium to come down. You will find the premium shrinking even the market shoots up as the VIX will go against CE premium. No doubt I am in favor of market moving up.

3. There could be volatility till the time VIX gets cooled off.

4. Use dips to buy CE. DO NOT RUSH. You cannot pay 115 premium for OTM CE 10500 which is still 250 points far away from spot.

ADVISE: Go long in nifty and bank nifty for target 10475/25372.

Option trade is advised for members on board.

Happy Trading!!

Thursday, 25 October 2018

NIFTY TREND

Nifty closed near month low on the expiry day paving way for the November series to climb from the bottom formed in October. 10249.6, 10138.6 and 10079.30 were the three bottom numbers formed in nifty which could be considered as a positive divergence. A minimum of 300-400 points bounce back can be expected from such level.

Bank Nifty has not broken 24250 bottom formed till the expiry.

Nifty has to close above 10250 and BN above 24925 today to initiate fresh long in the market next week.

If global cues help, we can see nifty moving to 10450 and BN to 25500.

Good Day!

Tuesday, 23 October 2018

NIFTY TREND

Nifty has tested 10102. I have posted that nifty will test 10111 level and look for a bounce back. Tomorrow could be very crucial for nifty to hold today's bottom.

Monday, 22 October 2018

NIFTY TREND

The first day of the week again opened with a positive note but could not last for a long time. There were two attempts by bulls to take the market up. But could not succeed.

If Nifty is able to take support at 10180/140 then we can expect a sharp bounce back. Since the expiry is just two days away, it is strongly advised not to be aggressive in taking up positions.

Sunday, 21 October 2018

NIFTY TREND

Nifty took a U turn from 10710 and again touched 10249 and finally closed at 10303, marginally above 10300. A bounce back is expected around 10111.

Bank Nifty also looks weak. It wont be a surprise if it retest the recent low of 24250.

Clue for options trade. One can hold on to PEs till the time nifty and BN reaches the above level.

If today's gap down does not give a chance to enter into PE, then one must wait for reversal and be on the Call side.

ALERT: Nowadays the gap up and gap down in nifty is too risky that any one who writes either CE or PE are in too much risk that the overnight position gets squared off in no time and they are left with no money to trade. Always hedge your option writing.

Suppose you write 10500 CE of November then you buy equal quantity of 10700 CE. This will protect you from risk. Trade with 25% of your capital. Do not invest 100%.

Happy Trading!

Thursday, 18 October 2018

NIFTY - OPTIONS TRADE

The price action of both PE and CE suggests no change in trend and NO TRADE is suggested.

This applies to both Nifty and Bank Nifty.

Take care!!

This applies to both Nifty and Bank Nifty.

Take care!!

Wednesday, 17 October 2018

NIFTY TREND

Bank Nifty and Nifty obeyed our levels posted yesterday.

Bank Nifty moved up to 25910 and unable to sustain the highs fell gradually hour after hour till the end of the day and settled slightly above 25128.

We have not taken any CE or PE and missed the jackpot as the steep fall from 25440 was not expected. We did anticipate 25800 CE / PE and 25700 PE to do wonders. It did. This was predicted by me and informed to all members to focus on PEs after 1.30 PM.

Nifty too looked very weak when it was breaking 10450, finally settled above 10450. It has closed below 10492, which was last week high. Now only a close above 10492 gives a further move.

Bank nifty too settled below Friday high of 25484 and settled at 25188.

Watch these numbers to go long in index as the bottom of 10138 and 24250 is intact.

Range for Friday trade : Nifty 10410-10526.

B Nifty 24906-25328

I have given exit from 11000 CE (November) to all the members and book profit. Entry was around 60-65 and exit above 90. High was 100. Assuming entry around 62 and exit at 95, ROI works out to 50%.

I will give next 100% sure trade. Stay cool and calm.

Trade with caution. Obey the levels. You will win.

Happy Trading!

Tuesday, 16 October 2018

NIFTY TREND

Nifty has closed above 10571. This augurs well for the nifty. One can go long in future keeping SL at 10410 for a target 10708.

Bank Nifty has been outperforming and we can expect a move up to 25868/955 if 25645 is crossed on an hourly basis.

Good Day!

Bank Nifty has been outperforming and we can expect a move up to 25868/955 if 25645 is crossed on an hourly basis.

Good Day!

STOCK PICK - CAPF & CENTURY TEX

CAPF has bottomed out and likely to continue to move towards north. An immediate target of 520/532 is inevitable keeping a SL at 475.

CENTURYTEX is on gains on a weekly basis and a close above 841.5 will take it to 878/920. Already in firm grip of bulls after suffering 5 consecutive weekly lows.

Good day!

REVIEW - SUNTV AND INFY

My pick SUNTV rocked yesterday with a good move when the hourly close was above 662. The technical level was obeyed. My congrats to the members on board who took futures position and made handsome returns.

Similarly INFY view was perfect and it never crossed 711. It closed below 694. We expect price movement much in line with what we have opined yesterday.

Good Day!!

Monday, 15 October 2018

MY VIEW - INFY

Today the results are going to be out for IT major scrip INFY. What is cooking in Nifty? Let's Analyze.

INFY has closed at 701, above previous month low of 694.70. This is a very positive sign.

But the present close indicates cat on the wall situation.

If you look at previous week high and low (730-665) the present close is at 701 which is exactly the mid point of high and low. Since yesterday's close is above previous month low, the technical indicate some cheers in the market.

Don't get biased on any scrip based on your holding. Do proper analysis.

I advise going long with a strict SL of 694.70 for an immediate target 725.

Be ready to participate !!

STOCK PICK - SUNTV

Sun TV is showing recovery on a weekly basis. A close above 661 confirms good move.

Go long in this scrip with a strict SL at 640. Target 685-694.

Best of Luck

PS:

Yesterday we picked Granules, Raymond and CG Power. All the three scrips gave good move.

Let us hope SUN (TV) shines well today!

Go long in this scrip with a strict SL at 640. Target 685-694.

Best of Luck

PS:

Yesterday we picked Granules, Raymond and CG Power. All the three scrips gave good move.

Let us hope SUN (TV) shines well today!

NIFTY TREND

Nifty has continued its northward journey and closed above 10500 and Bank Nifty is under consolidation around 25300-400 level.

As indicated the move could be in sideways due to index is under consolidation and preparing for a next up move.

DO NOT SHORT INDEX AND THE MARKET IS BUY ON DIPS MODE.

Sunday, 14 October 2018

TRADE

We have already initiated long in Options trade. The strike price with BUY price STOP LOSS and TARGETS are sent to members on board!!

Be first to catch the move. No point regretting. You must have courage to trade.

Knowledge and courage both should go together. The combination of both pours profit.

TECHNICAL VIEW - COALNDIA & ZEE

The price action in Coal India has been very aggressive since 8th October 2018. Now a close above 283 should take the scrip up to 293.50.

Zee has been closing high for the past 4 days and higher highs and lower lows. But it all looks like short covering happening in this scrip. Long or OTM CE can be initiated only on a daily close above 476.

Take care!!

PS : Anyone requiring suggestion on levels for any scrip can send me an email so that I will be able to answer the query. narayanansrirangam@gmail.com

Please send only one scrip. DO NOT SEND BIG LIST.

Friday, 12 October 2018

NIFTY TREND

Yesterday I have posted about significance of 10482 which was last week high. Today Nifty could touch this number but could not close above this. If nifty closes above 10492 (Friday High) on hourly basis it will lead nifty to next level 10572/10603.

On bank nifty 25470 becomes a very critical resistance and 24250 acts as strong support.

Friday move of 250 points is a relief rally. I has not closed above previous week high. It indicates sideways move on Monday.

For Nifty 10316/261 are critical levels and for Bank Nifty 24678/24240 are critical levels.

The gap is very wide and you cannot CEs and PEs to perform or you cannot expect market to go one sided. It should be a side way move.

Keeep this in mind when you go for options trade during next week.

Happy trading!

Thursday, 11 October 2018

NIFTY TREND

Wait for the index to show some positiveness. Exercise patience.

I advise no trade. if Nifty is able to surpass 10392 you can have a better Monday opening. Else range bound. Take care.

I advise no trade. if Nifty is able to surpass 10392 you can have a better Monday opening. Else range bound. Take care.

When nifty has dropped from 10930 to 10200 it means the under current is weak. Index is vulnerable. On a weekly basis it must show strength. For example first week high 11035 low 10261 close 10316.5. This week still we are below 10316.50. Again this week high 10482 low 10138 and close should be above 10316.50.

On a weekly basis, lower lows and lower highs are formed. Next week if you find nifty above 10482, then you are sure of up move. Till then we must watch market.

There is nothing called technical . We must wait for the right time.

Wednesday, 10 October 2018

ICICI - VIEW

The scrip recovered from its recent low of 296.50 and on a weekly basis it has shown improvement, but on a daily close it still shows turbulence. Better to avoid the scrip till the time on a week on week basis it gives positive outlook.

One should buy this scrip only if it closes above 325 .90 on a daily close basis.

When the market is undergoing big correction, any scrip which has closed above two week high only can withstand and go up. All scrips which do not meet with this condition falls.

You can validate the above condition with the scrips which are positive today despite weak opening of index.

Learn more. Study more. Money will pour.

Good Luck!

One should buy this scrip only if it closes above 325 .90 on a daily close basis.

When the market is undergoing big correction, any scrip which has closed above two week high only can withstand and go up. All scrips which do not meet with this condition falls.

You can validate the above condition with the scrips which are positive today despite weak opening of index.

Learn more. Study more. Money will pour.

Good Luck!

TCS VIEW

As the quarterly results are likely in this week, the trend of TCS looks weak. The price action is negative. It may go down to 1970. One can try 20000 PE. It closed at 61.95 today. It could double tomorrow. One can try with a SL at 55 for big gain 100+.

Tuesday, 9 October 2018

MY VIEW

My view on Nifty remains bearish. If nifty breaks lower level of 10198, we may see 10081/10060 from where one can expect support.

Any bounce back is just a sell on rise. Be alert.

Bank nifty has support at 24250, which has been the recent low formed in this week. If that is broken then we may see BN drifting down to 23906.

Clue for trade: Wait till 17th (next weekly expiry). There are bright chances of short covering from 19th onward. We will get a much clearer picture when we are near third week to reasonably predict the expiry numbers of nifty and bank nifty. It is too early as the VIX is high.

NIFTY TREND

On a weekly trend Bank nifty is showing some positive sign, but Nifty has not yet.

Today also Nifty opened positive but remained range bound during the whole day and closed 50 points down.

Bank Nifty also lost 73 points and closed at 24528.

Reversal is not yet visible. Only when the VIX cools down to 16-15% level, we can expect up move in the index. Till then you will find high volatility and high premiums on options.

One can be assured of a big move - nifty 400 to 600 points and BN 1000-1500 points jump. Better exercise patience and grab a good opportunity.

Patience Pays!!

Today also Nifty opened positive but remained range bound during the whole day and closed 50 points down.

Bank Nifty also lost 73 points and closed at 24528.

Reversal is not yet visible. Only when the VIX cools down to 16-15% level, we can expect up move in the index. Till then you will find high volatility and high premiums on options.

One can be assured of a big move - nifty 400 to 600 points and BN 1000-1500 points jump. Better exercise patience and grab a good opportunity.

Patience Pays!!

Monday, 8 October 2018

BE ALERT

One of the brokerage houses in Chennai is not finding its customers to place orders on phone or online as the volatility in index has wiped out more than 50 Crores in their clients' accounts. The money was wiped out on 21st September. Till date the customers are not placing order. The ground level situation is not good.

It will take time for investors to recover from this rude shock. It has shattered the confidence level.

It is better not to trade if you have not taken position in PE. Wait for reversal. It will take minimum 15 days to have a reversal trend due to nifty closing 5-6% negative on weekly basis.

Trade with Care!

REVIEW

Tata Elxsi was posted yesterday with chart clearly showing buying should be done only above 1196.20.

Respect the levels. Now only a daily close above 1027 validates up move.

Trade with utmost care.

Respect the levels. Now only a daily close above 1027 validates up move.

Trade with utmost care.

NIFTY TREND

Nifty today formed a low of 10200 and it visited the area twice and after a quick recovery it closed at 10348. All such moves are happening in the last 30-45 minutes. On Friday it was a downward movement in the last 30 minutes.

Please bear in mind that these moves are beyond technical and happening in NO TRADE ZONE. It is not advised to catch the moves. Nifty moving 150 points plus or minus in such a short duration means market is highly volatile and any bet on options is 100% risky. Avoid Options trade till such a time volatility reaches below 15%.

When trend reverses positional, you will find posting here.

Till then Good bye!!

Sunday, 7 October 2018

Saturday, 6 October 2018

NIFTY TREND

Nifty has opened gap down on the third consecutive day, shedding 300 points as the RBI Policy failed to impress the market. BN has closed at 24443, below 24760. BN closed at 24759.6 on April 5, 2018. Today's down move has broken 5 month support level.

Now next important support levels are 24062 and 23657.

Nifty looks more volatile than BN. It has closed above the low made on April 5, which is 10253. If it breaches 10253, then major supports are at 10121 & 9976. Nifty likely to take support at 9780.

We are almost reaching the point where the bearish trend should find its end. Nifty another 600 points and BN 1000 points further down trend likely.

DO NOT LOOK FOR REVERSAL TILL THURSDAY!!

Note these numbers and trade with caution!

Thursday, 4 October 2018

NIFTY TREND

Nifty opened gap down and the day ended with a loss of 259 points and BNF down by 250 points. Nifty has overreacted to the situation. IOC, BPCL and HINDPETRO tanked 20% apart from RIL 8%.

The worst is not yet over. October month has seen only 3 sessions and with in that index has lost 4.5%. Looking at the scenario, market is likely to touch 9700 level to complete the correction cycle.

Bank Nifty likely to touch 23600.

Members have been given the perfect levels to make use of the down trend.

Do not go long in this market. Any bounce back is just sell on rise. Buy PE on rise and look for the above numbers and make gains or wait for reversal.

Happy Trading!!

Tuesday, 2 October 2018

STOCK IDEA

Today the picks are:

STRIKE PRICE, BUY PRICE, SL, TR SENT TO MEMBERS ON BOARD:

STRIKE PRICE, BUY PRICE, SL, TR SENT TO MEMBERS ON BOARD:

NIIT TECH, MINDTREE, UBL AND MCDOWELL-N

NIFTY TREND

On Monday Nifty Touched 10821 and from there we saw a quick recovery and closed +70 points at the end of the day. The low recorded on Monday could be the weekly / monthly support level for nifty. Shorts can be created only if nifty breaches 10820 on a daily close basis.

Index has turned green after a month and the up trend is likely tot remain for few sessions. Nifty is expected to touch 11139 and bank nifty 25500/700.

The overall bearish trend still remain intact. This up move is a temporary pull back.

Both the index likely to have limited move and remain direction less till RBI policy is out.

Clue for trade. Pick 111000 CE around 100 SL 96 for quick doubling.

Happy Trading!

Wednesday, 26 September 2018

NIFTY TREND

Nifty Future has strong support at 11005 and BNF at 25228. Initiate PE only if these levels are broken for intra day trade tomorrow.

For positional trade one should wait for nifty to break 10912/866 and BN 24678.

Do wait for trade. Any gap up opening also is getting sold and index is pulled down.

Allow the expiry to complete. Wait for direction.

No trade till then!

For positional trade one should wait for nifty to break 10912/866 and BN 24678.

Do wait for trade. Any gap up opening also is getting sold and index is pulled down.

Allow the expiry to complete. Wait for direction.

No trade till then!

Tuesday, 25 September 2018

NIFTY TREND

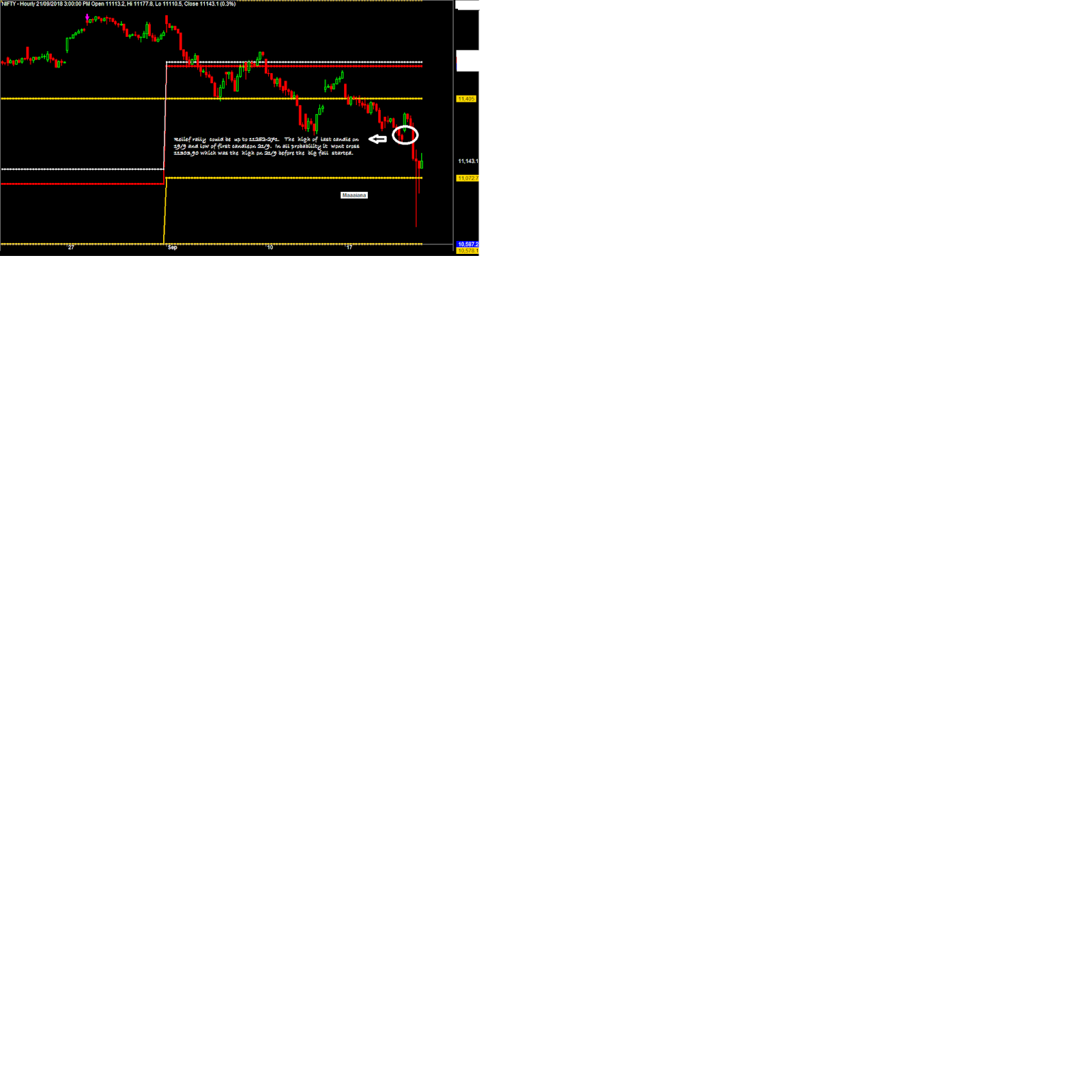

The trend is reversed and you can call it a relief rally. Nifty can bounce up to 11167 and BN till 26613.

The main trend is still weak.

Do not get carried away by the up move. Take care

Monday, 24 September 2018

NIFTY TREND

Nifty could not cross 11170, the day high made yesterday. Now you have to watch the levels. The low made during the month is very critical. Any close below 10866 signals further downside for the month of October and the correction may continue up to 10550/447.

Bank Nifty likely to reach 23800, previous low of 23605 on 23/3/2018 from where reversal took place.

The above levels are positional trades and not intra day. One can take the positions when nifty and bank nifty gives a relief rally.

Next 3 days likely to be very crucial and the increased Volatility index indicates high premium on both CE and PE. Any sudden drop in VIX will lead to complete erosion of premiums. Avoid trading as these moves are meant for market makers who play with huge money.

Avoid buying PE as the market is already showing oversold situation. If there is a relief rally buy PE of October and wait for profits. Do not buy CEs till such time the trend reverses.

HAPPY TRADING!

Saturday, 22 September 2018

Nifty opened gap upon Friday and around 1

Pm witnessed a heady fall to 10800 level and a sharp bounce back to

11200 in few minutes

Bank nifty tanked 1500 points during intra

day and finally closed near 25600.

No normal investor would have made money since the move was

very fast. The previous week low of 10866 is very critical not only for this week but for the next month also. If 10866 is broken, we may witness 10578 followed by 10240/10100.

Under these circumstances, it is strongly recommended to avoid aggressive position on either side. Be cautious during next week.

The Banking

sector is likely to under perform along with non banking finance

companies.

Probably the

trend could continue till Wednesday.

Expiry could

be very interesting this week and it all looks

like a sure casino game waiting for us on the

expiry day.

Happy Trading!

Thursday, 13 September 2018

NIFTY TREND

Bank Nifty has hit the target of 26600 and took a reversal from there. Nifty has taken support at 11278 and further downside is negated as the major component has already hit target as per my previous post.

From 11760 to 11260, nifty shed 500 points. Now retracing could be anywhere between 38 to 50%. Whenever steep / quick fall happens, it won't retrace to 62% immediately. As per the above, nifty likely to reach up to 11510 till month end expiry.

Bank Nifty reversed from 28200 to 26600. Totally 1600 points. Assuming 50% reversal of 800 points, BN may reach 27400 till expiry.

Does not sound logical??

Do not get carried away by gap up and gap down as these are traps to grab your money.

We have only 8 trading days, excluding today. Be careful. Down side may open only if 11278 is broken. Upside is possible if 11620 is surpassed. Now the gap is 11278-11620. Do not gamble when the gap is too wide. 300+ points.

Avoid buying options, instead sell CEs above 11600 and PEs below 11200.

INDEX IS RAISING!! NO SHORTS.

Tuesday, 11 September 2018

NIFTY TREND

Nifty shed 300 points in 2 days to reach 11274. Bank Nifty down by 600 points in two days. This has completely eroded all the CEs.

Nifty destination is 11150 and bank nifty 26600.

Expiry trade: Keep focus on 26900 CE or 26700 PE, which ever is available for 5.00 buy for multiple returns. SL should be 50% of cost. Try maximum 5 lots please. Do not bet all savings.

Good day!

Sunday, 9 September 2018

BAJAJ AUTO & BHARTI ARTL

BAJAJ AUTO AND BHARTIARTL CALLS ROCKED LAST WEEK...

BAJAJ AUTO BUY AT 25 AND HIT ALL OUR TARGETS

BHARTI ARTL BUY AT 4.75 TOO GAVE US THE BEST RETURNS

CIPLA, TITAN AND HIND PETRO HIT SL WITH MILD LOSSES.

WHAT IS IN STORE FOR THIS WEEK???

MEMBERS ON BOARD ALREADY HAVE THE TRADE RECOMMENDATIONS.

WHEN NIFTY AND BANK NIFTY SLEEPS, OUR STOCK PICK ROARS!!

WE DO NOT INITIATE INTRA DAY TRADE. WE TAKE POSITIONAL..

THAT IS THE POWER OF PREDICTION..

WILL POST UPDATES ONCE OPTIONS HIT OUR TARGET!!

NIFTY TREND

The week witnessed a low of 11391 and a sharp bounce towards 11600 and a weekly close 200 points above the low. Bank Nifty also shed more than 1000 points but recovered 350+ points only from the low of 27140.

Everything happened in the wink of an eye.

Unless the index breaches the last week lows, we cannot initiate short position. Similarly as long as index is below 11620/27772, we cannot go long.

We are in no trade zone where the direction is undecided. Better to be on the sidelines and wait for the right time to enter.

This week range for nifty and bank nifty is 11500-11650 and 27310-27660.

A decisive close above the top band gives way for initiating long position in index and vice versa.

Wednesday, 5 September 2018

NIFTY TREND

Nifty recovered at 11391 as per my previous post. Of course Bank nifty overreacted and reached 27138.

The total fall is 1000 points in bank nifty and 360 in nifty. A pull back rally is likely on Thursday which will take nifty above 11500 levels. Remember, the worst is not over yet. Unless 11620 is crossed on a daily close basis, the trend is bearish. For bank nifty the number is 28016.

Clue for expiry trade. Try 27500 CE around 15 -18 for multiple returns. Sl 50% and Tr 100+.

Best of Luck!

The total fall is 1000 points in bank nifty and 360 in nifty. A pull back rally is likely on Thursday which will take nifty above 11500 levels. Remember, the worst is not over yet. Unless 11620 is crossed on a daily close basis, the trend is bearish. For bank nifty the number is 28016.

Clue for expiry trade. Try 27500 CE around 15 -18 for multiple returns. Sl 50% and Tr 100+.

Best of Luck!

Monday, 3 September 2018

NIFTY TREND

Nifty today closed 98 points below Friday close and that too on the first trading day in September and on the first day of the week. All these above points are valid for us to conclude that 11760 is the top level for the next few months. Nifty is almost 5-6% above previous high to initiate correction ( 11185-11760). The rally started from June 29th has ended on August 31.

For nifty down side target for September is 11391/11300. It is just 460 points down from 11760. Still more to come.

Ye Dhil Maange More!!!!

Bank nifty also pared all gains and closed near 27800. Next immediate target for bank nifty is 27650/27500. It is likely to reach 27327 from where it started its journey in August.

Don't be long in this market. Nifty wont recover throughout this month.

Wednesday, 29 August 2018

NIFTY TREND

Today Nifty never shown any recovery except for an hour between 2PM to 3PM. Again at 3 PM it was dragged below 11700 and closed at 11691.90. On expiry day nifty has to hold above 11663 to move above 11700. If 11663 is broken on an hourly basis, it would be a close below 11575-550.

Bank Nifty has never stayed above 28322 as mentioned in my earlier post. Good news is that it has not broken the low of previous day.

Option strategy for expiry trade sent to members on board...

Tuesday, 28 August 2018

NIFTY TREND

The day opened with a gap up, but immediately the index went in to correction mode.But by the end of the day it retained all the gains and closed near the opening price. The momentum is slow but bulls are likely to see nifty above 11810 in this expiry.

If you see nifty above 11777 and stays above for an hour, you can take 11800 CE which will give multiple returns.

Bank Nifty must stay above 28322 or an hour or on a daily close basis, to clinch new high. Target for BN spot is 28550/725/903, of which 28725 sounds reasonable and logical. Bank Nifty uptrend is likely as the key player HDFC Bank is all set to touch 2150. If HDFC Bank contributes 400 points and other banks put together give 100-150 points, BN should easily surpass 28769 from yesterday close. Hence 28725 sounds logical to me.

Best of Luck!!

Monday, 27 August 2018

NIFTY TREND

The trend remains UP.... We Love you NIFTY...

GO WITH THE TREND!!

NIFTY SPOT TARGET 11810

BANK NIFTY SPOT TARGET 28800

ALL BEARS ARE IN COMA... LYING IN AIIMS.

GO WITH THE TREND!!

NIFTY SPOT TARGET 11810

BANK NIFTY SPOT TARGET 28800

ALL BEARS ARE IN COMA... LYING IN AIIMS.

STOCK OPTIONS

Yesterday our picks PEL and RBL Bank rocked.

Our picks for today ???

Watch PIDILITIND and Wipro and LICHSGFIN

Buy or Sell?

Already Options trade recommended to members on board..

Good Day!

Our picks for today ???

Watch PIDILITIND and Wipro and LICHSGFIN

Buy or Sell?

Already Options trade recommended to members on board..

Good Day!

Friday, 24 August 2018

STOCK OPTIONS

Last week all our picks rocked. Grasim, GAIL, Lupin, Sunpharma, NTPC and CIPLA.

The gain was substantial. This week we have identified 5 scrips which will give good returns.

Focus on OMC scrips.as Short covering in these scrips could witness a sharp reversal.

Options pick buy, SL and targets for members on board.

NIFTY TREND

After having touched 11620, nifty has retraced 11533 in this week. Though the daily candle suggests a down trend the weekly bullish trend remains intact.

We must wait for a clear direction during the next week. The expiry moves and tight grip by bulls keep the nifty forming higher tops and higher lows day after day. Unless a weekly confirmation emerges on reversal, there is nothing negative about this marketl

Bank Nifty has been reversing at 27779/27782 levels for the past two weeks. Assuming 27780 remains a good support then we can expect fire works in bank nifty. If 27780 is broken on Monday, then Nifty may not be able to gain substantially. Taking support from few scrips by way of short covering could be the only option for nifty to keep floating around 11550.

To summarize, up move is limited. Also no major down side. The trend is neutral.

Wait till next Friday and once the direction is confirmed we can sit on CE or PE.

Watch my blog on Friday Morning next week.

Till then .. Good bye!!

Saturday, 18 August 2018

STOCK MARKET - DOs AND DONTs

When you are in to investing in stock market your first investment is PATIENCE. Money is secondary.

Secondly you must acquire technical knowledge on stock movements, price action and volumes. Without this you will land into trouble. Go with the trend and never be against it. If you do not participate in a bull run or bear trend, it is OK. But if you are 180 degrees opposite to market direction, then you will land into serious trouble.

Thirdly after investment, you must keep track of the prices and book profits as per technical levels and exit if the stock is hit by bad news Eg: PNB.

Finally, you must always keep SL and trade under any circumstances; otherwise you run the risk of losing capital.

Before making investment think twice, thrice and do not chase any stock just because you have missed the rally. This is a wrong way of picking trade which will put you in all difficulties.

My members do not grudge for not picking trade. They take positional trades and sell with profit when everyone wants to buy.

Make stock trading and your investment a trouble free affair and be happy with mild profits.

Never carry options and futures without hedging it.

Options are often misunderstood as lottery. Actually it is a hedging tool against Future contracts.

Do not hesitate to mail me in case you have trouble.

narayanansrirangam@gmail.com

STOCK OPTIONS IN WATCH LIST

We shift our focus to specific scrips as the Index may dance and erode premium.

Our focus is on Pharma, Power and FMCG this week.

Last week we captured GRASIM, CIPLA, LUPIN and SUNPHARMA.

This week we have handful of picks. You will get posting on the returns made by our clients.

Still GAIL is in hit list. Refer my previous posts.

Happy Trading!!

Our focus is on Pharma, Power and FMCG this week.

Last week we captured GRASIM, CIPLA, LUPIN and SUNPHARMA.

This week we have handful of picks. You will get posting on the returns made by our clients.

Still GAIL is in hit list. Refer my previous posts.

Happy Trading!!

Thursday, 16 August 2018

NIFTY TREND

Already posted that PEs are in non performing list. Status-quo remains same. Both the index are in buy. Do not short the index and buy PEs.

LUPIN AND GAIL

KEEP THESE TWO SCRIPS IN WATCH LIST.

SEE THE PRICE ACTION.

OPTION TRADE SUGGESTED TO MEMBERS ON BOARD

SEE THE PRICE ACTION.

OPTION TRADE SUGGESTED TO MEMBERS ON BOARD

Monday, 13 August 2018

Sunday, 5 August 2018

NIFTY TREND

Last week nifty formed a low of 11235 on weekly expiry day, forming a bearish belt. But it opened with a gap up on Friday to close yet again a new high created during this week, 11390.

It is advised to remain extremely cautious as profit booking at higher levels are likely during the first two days of the week.

Nifty is likely to be bullish and the trend is up. If 11429 is crossed on a daily close basis, then next destination is 11600+. Bank Nifty will witness 28592.

Do not Short this market.

Since this month is very long and the expiry is on the penultimate day of the month, we can witness high volatility. But it is prudent to be on the long side as long as Index does not fall in sell zone - 11222 and below.

Happy Trading!!!

Saturday, 28 July 2018

NIFTY TREND

Nifty and bank nifty - both are in the breakout mode. Any dip is a buy. One can expect a minimum of 11450-550 in nifty and 28100-28350 in bank nifty during the next week.

Do not expect any big correction and do not be in short side if you do not believe in this bull run. As long as S&P index has not crossed 2872 ( previous high) our market wont come down. It is just 40 points away from ATH. August month is likely to set record high globally for all indices.

Our members have already taken 11300 CE on expiry day at bottom and holding it till we meet our target.

Refer my previous postings where I have clearly mentioned break out in BN to happen once it crosses 27164. Had you followed the blog, you would not have missed the rally in bank nifty.

Any way, for good profits, hang on to 280000 CE month end expiry around 200-220 for target of 500+ with SL at 194.

Tuesday, 24 July 2018

EXPIRY TREND

This expiry could be anywhere between 11060-11100. Since Bank Nifty has no inclination to cross 27165, we cannot expect any big move. Of course, it may move in the north direction immediately after expiry.

It is advised to trade with extreme caution during the next two sessions.

Take care!!

It is advised to trade with extreme caution during the next two sessions.

Take care!!

NIFTY TREND

All my followers are in jubilant mood. We have made 30% on carry over option in the morning and in the afternoon the dip in nifty helped in picking CE at the best rate and again got a nice exit at 11140. It was a day when money was pouring like rain.

We go by our levels which are very accurate.

Nifty and bank nifty -both are in buy mode. One can expect a modest close in this expiry and fire works may continue after expiry also.

Now we do not keep any position. Any further trade only when Nifty crosses 11167.

Happy Trading!!

Monday, 23 July 2018

NIFTY TREND

There could have been much disbelief among the investors about nifty movement. But at last our index is going to guide US market to surpass thee previous high. We may see S&P surging ahead towards 2872 which was the previous high. Nasdaq has already surpassed the ATH recently.

This is just a comparison to see whether our index is at par with US market. For all practical purposes Nifty takes cues from itself and is independent from other index. It is not necessary for our market to follow the other markets.

The stellar I quarter performance of large caps, good monsoon, slash in GST paves way for further lift in the index before expiry.

What to expect with in this expiry:

Nifty can reach 11225 surpassing the previous high of 11171. Anything above is a bonus for the investors.

Bank nifty can reach 27350. This is possible if the spot closes above 27150 on hourly basis.

Happy Trading!!

Friday, 20 July 2018

NIFTY TREND

Nifty closed today above 11000, renewing its interest to surpass ATH. Last week was a consolidation week where 10925 level was tested. Technically nifty is already in bullish mode, a daily close above 11060 should take nifty near 11200.

Bank nifty has closed 93 points below previous week. Once 27165 is taken out in Spot, one can see big jump in bank nifty. Wait for this level to be broken on hourly or daily basis.

Keep a minimum target in nifty 200 points from 11010 and 27420 on Bank nifty given the fulfillment of above conditions.

Our members are already long in Nifty options call with one more doubling in the last week. Remember we have already made more than 200% in 10700 CE. Trade for July already closed. We try jackpot on 26th risking a small amount.

We do not trade everyday and we look for doubling trades only. All my members are now technically sound to decide whether to enter into trade or not on any given day. They learn while they earn.

My best wishes to all new entrants for a very new beginning in their trading style and perfect TEN Trades to grow rich with a small investment.

Do reach me on narayanansrirangam@gmail.com for August entry.

Happy Trading!!

Thursday, 19 July 2018

NIFTY TREND

Nifty takes support at 10929 and face stiff resistance above 11070. The range is 10925-11060. Unless any one of these numbers is broken, there is no big move.

Having reached 11078, just 100 points from ATH, is there any chance of making new high before this expiry?

It is possible only if nifty stays above 11060 on a daily close basis.

Bank nifty on the other hand is also facing stiff resistance at 27165. Support seen at 26689.

Keep watching for these numbers and make use of the above levels when you find them on daily close basis.

Happy trading!

Tuesday, 17 July 2018

ATTENTION - MEMBERS

My phone is given for servicing. Please hold on to long with previous close as SL.

NIFTY TREND

Nifty and Bank nifty both ready for another bull run. It took support near 10929. See my previous post to confirm the same number posted as a strong support.

Now the next level to watch in nifty is 11076. Only if it crosses this number, new ATH is possible. One cannot rule out 11225 if this number is crossed in this week.

Bank nifty has crossed 27k and we can expect 27375.

My followers are again long in CE yesterday and they have positioned at a 11.30 AM when the market was reversing. They are holding the CE till expiry for big gains.

Remember, this month we have been long right from day one and all have doubled the investment twice.

I can take new members only during August I week as I focus on members batch by batch. Do reach me on narayanansrirangam@gmail.com

As committed, I have been giving doubling trades. It is for the investor to make best use of the advises and multiplying the money.

Happy Trading.

Sunday, 15 July 2018

THANK YOU

My best wishes to all new entrants in this week who are ready for a new beginning and limited trade in a month.

The membership group for July is almost full.

Good luck.

I will invite new members only by next month.

The membership group for July is almost full.

Good luck.

I will invite new members only by next month.

Saturday, 14 July 2018

New Members Invited

In order to make the small investors aware of the levels and teach them technical and pick only profitable trade, I would request those who suffered losses to make best use of our technical levels and good trades. You can recover all your losses in a year if you follow disciplined trade.

Make a new beginning and try out . Most of the losses are arising due to ignorance of levels.

Think ... Decide and Act...

Ultimately it is your decision to get in to disciplined trade that will make your life happy...

Do mail me at narayanansrirangam@gmail.com

Friday, 13 July 2018

NIFTY VIEW

Nifty has reached a stage similar to December weekly close.

If it touches 11400 by this expiry it is not a big surprise..

My followers are big winners as I have recommended 10700 ce from July 1st.

They are more than double now and holding with sl at 10976 for big gains.

Do not miss good trades. Make profit as you start with small capital.

Do try out with my powerful technical and guidance.

Do mail me at

narayanansrirangam@gmail.com

Be a winner. Don't worry about market direction, inflation, trade war bla bla bla...

Bullish or bearish... Be trendish..

If it touches 11400 by this expiry it is not a big surprise..

My followers are big winners as I have recommended 10700 ce from July 1st.

They are more than double now and holding with sl at 10976 for big gains.

Do not miss good trades. Make profit as you start with small capital.

Do try out with my powerful technical and guidance.

Do mail me at

narayanansrirangam@gmail.com

Be a winner. Don't worry about market direction, inflation, trade war bla bla bla...

Bullish or bearish... Be trendish..

Tuesday, 10 July 2018

Double and Quit

We have already identified the up move and long on Nifty 10700CE and doubled our amount. Entry at 121 & exit today morning above 250.

Now we wait for any dip to enter.

Our members follow disciplined trade.

Are you missing such trades?

Do mail me at

narayanansrirangam@gmail.com

Now we wait for any dip to enter.

Our members follow disciplined trade.

Are you missing such trades?

Do mail me at

narayanansrirangam@gmail.com

Monday, 9 July 2018

Nifty trend

Today nifty surpassed 10851 thereby making it clear that this market belongs to bulls.

Next target is 10929 & there after new ATH. Bank nifty has crossed 26744 and next move is 27k + in July.

Do not short this market and do not buy Puts and be with the trend.

Happy trading!!

Next target is 10929 & there after new ATH. Bank nifty has crossed 26744 and next move is 27k + in July.

Do not short this market and do not buy Puts and be with the trend.

Happy trading!!

Sunday, 8 July 2018

NIFTY TREND

As such the nifty and bank nifty - both are in buy mode. But if Nifty spot is able to surpass 10828 on an hourly basis, we can see upside move. Any close below 10745 will see nifty melting down towards 10640/537.

Bank Nifty Spot is shying away from crossing 26577. Watch out for 26410. If BN Spot close below this on hourly basis, then it can lead to 26250/160.

Do not try to predict market and go by these levels if you want to be a winner.

Happy Trading!!

Beware! Next week your trading track will be bumpy!!

Subscribe to:

Comments (Atom)